AZZ Inc. Reports Fiscal Year 2026 First Quarter Results

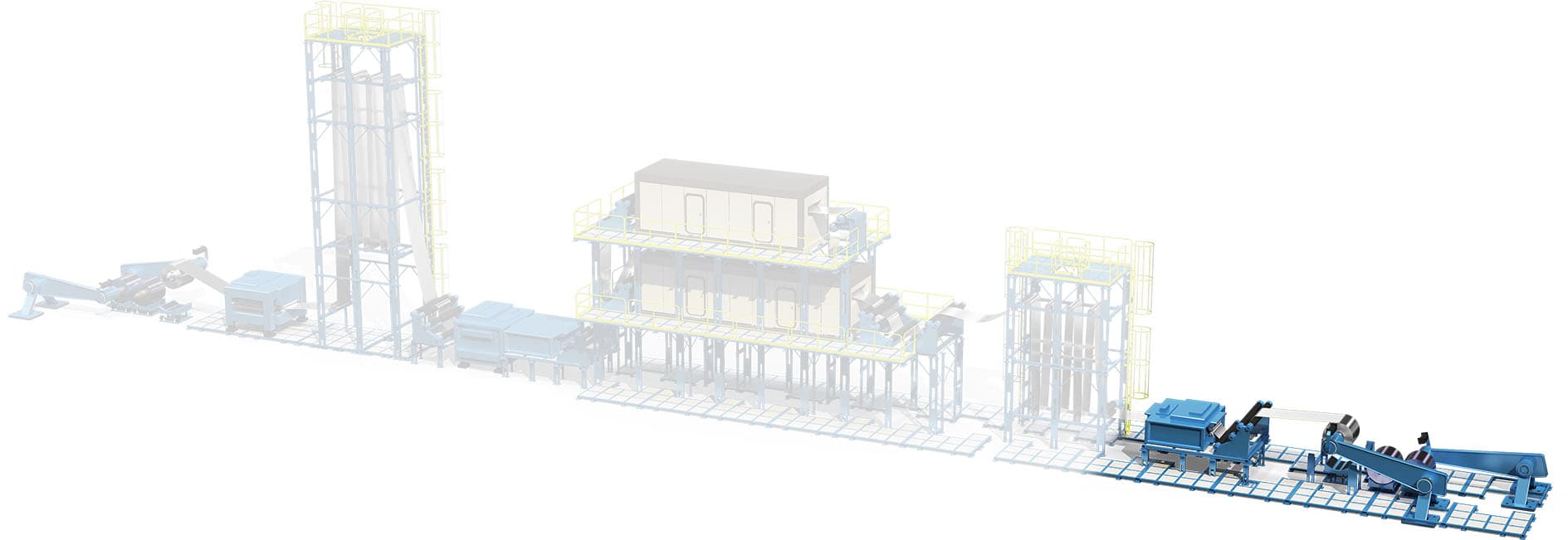

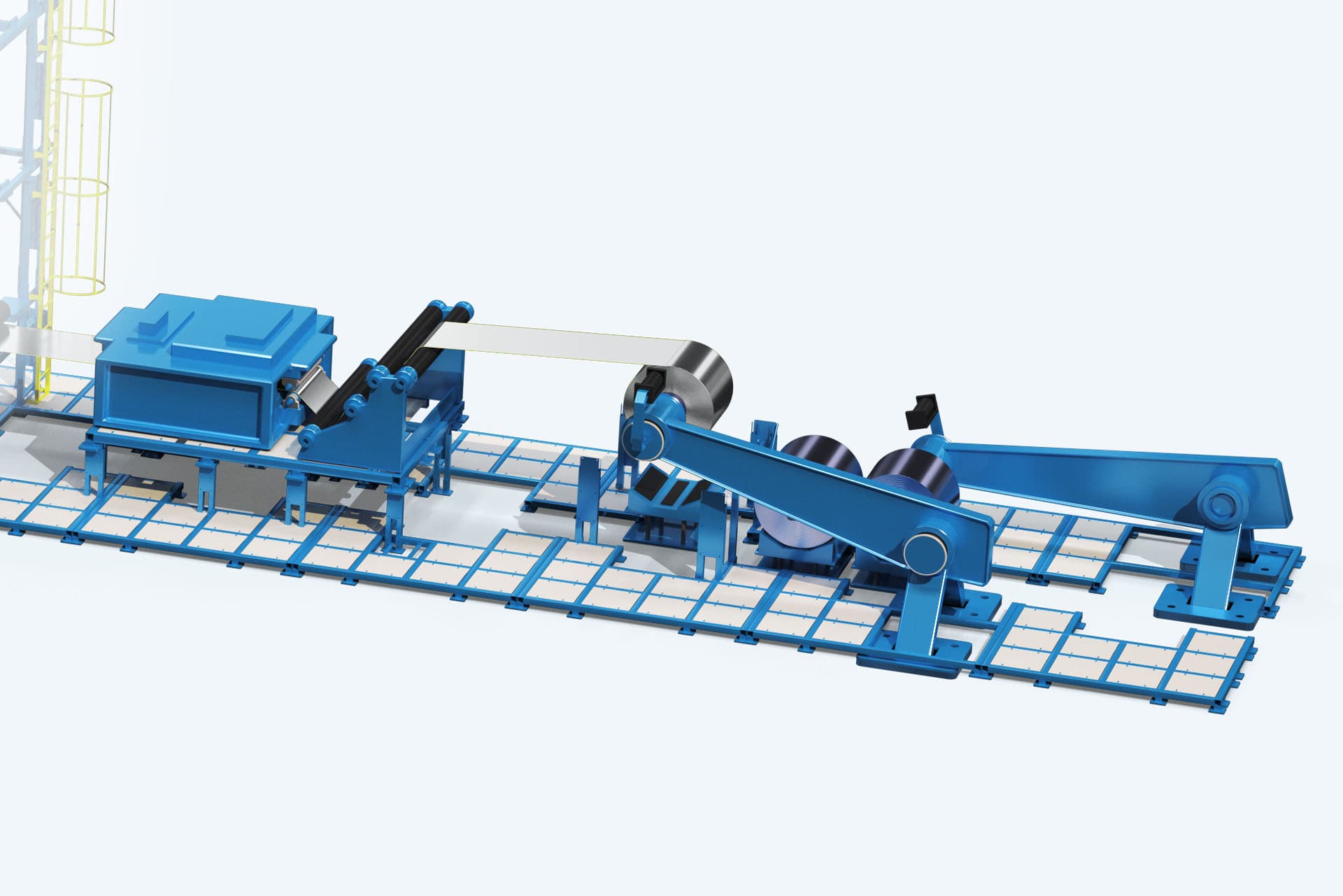

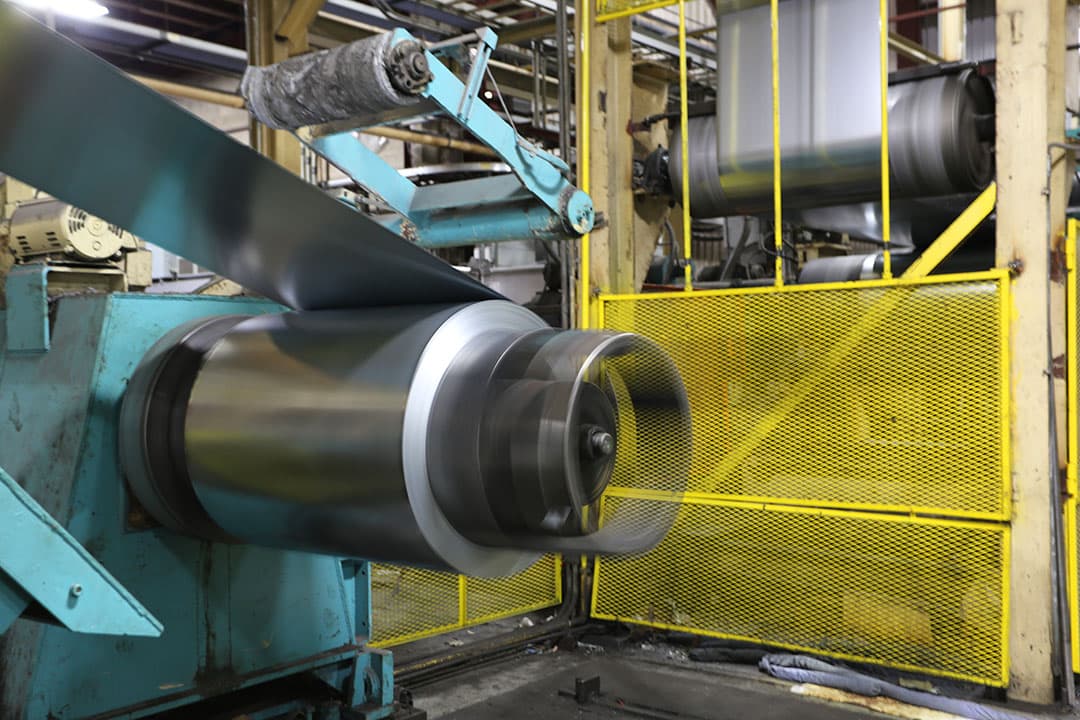

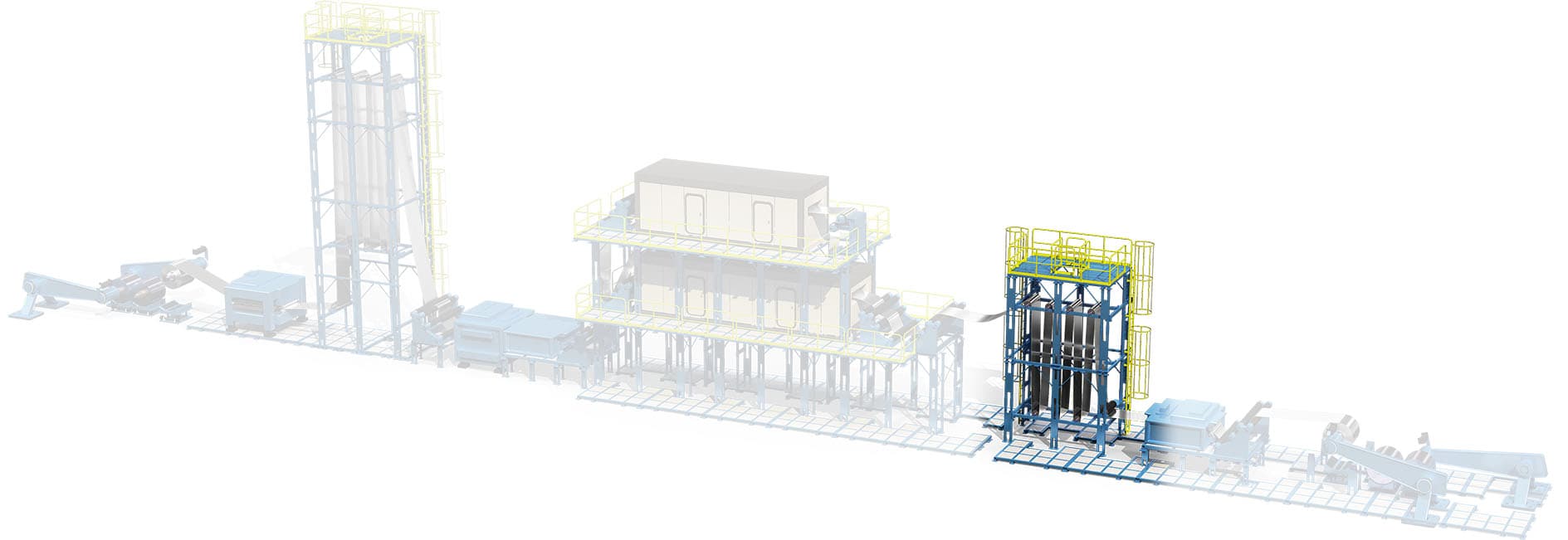

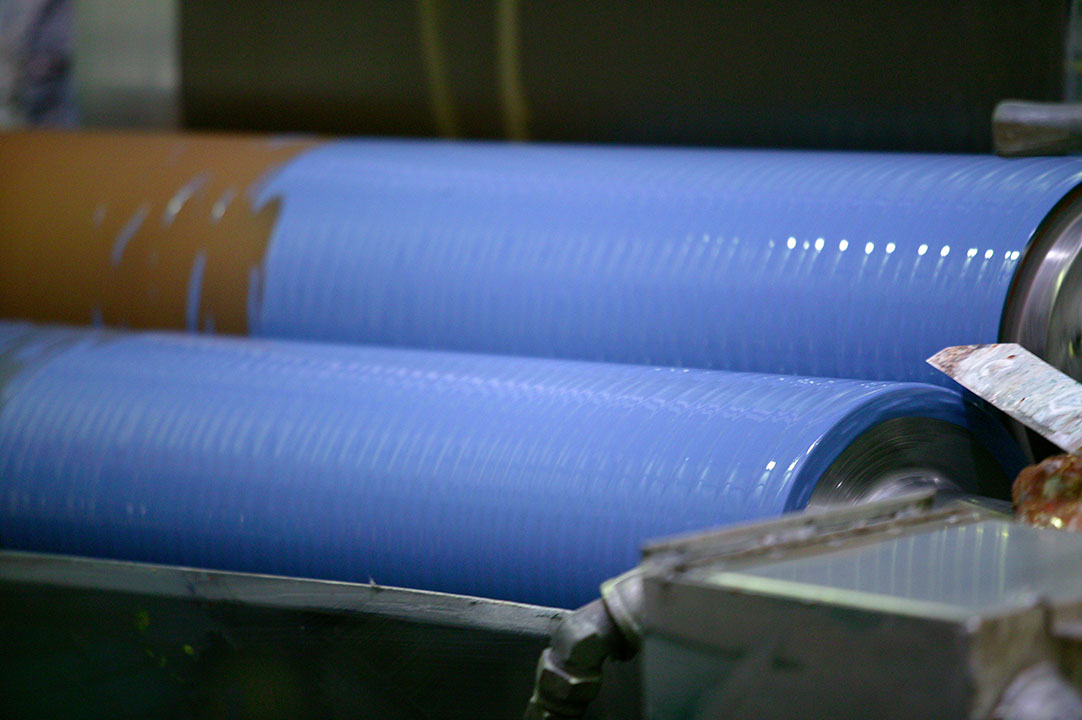

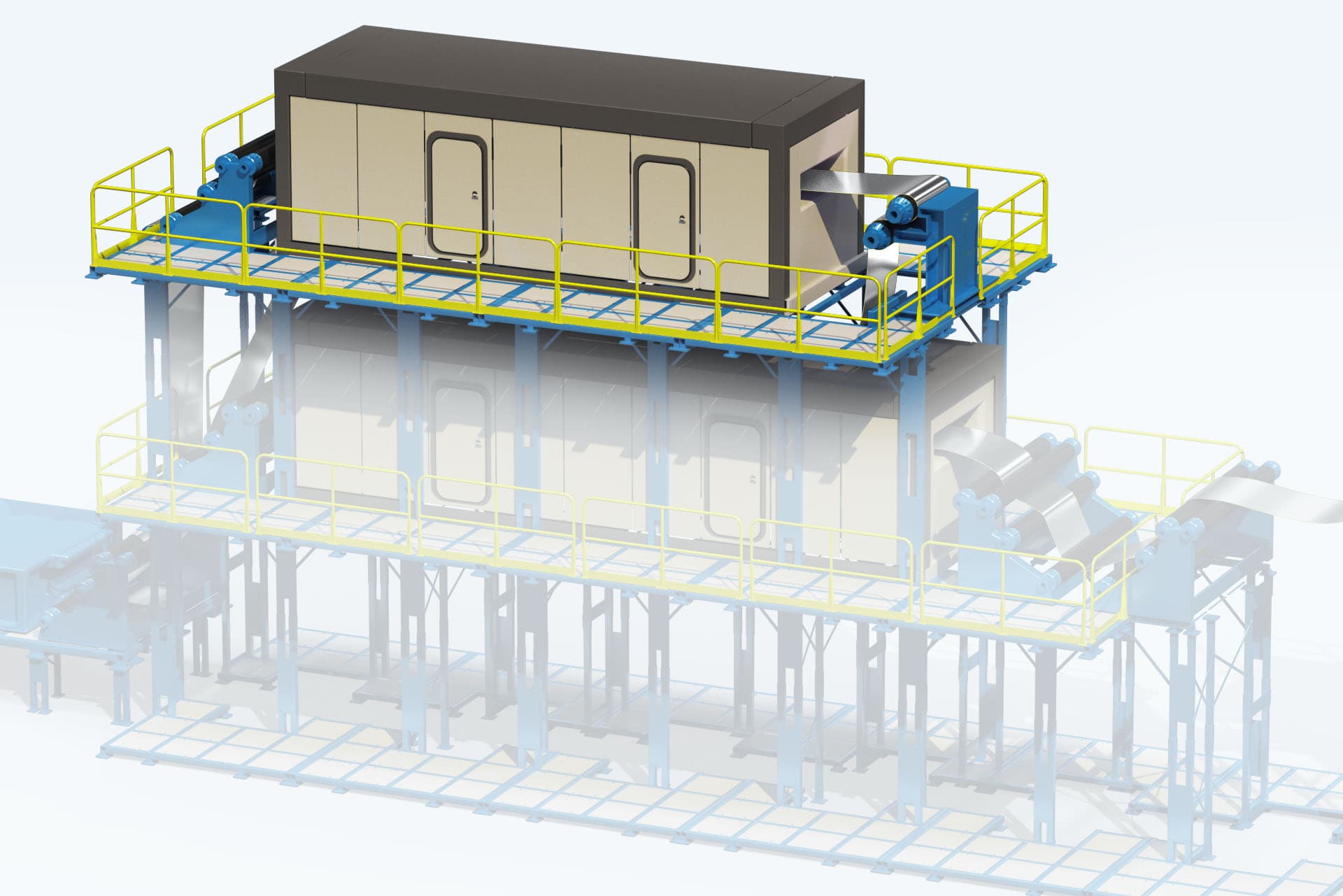

July 9, 2025 - FORT WORTH, TX - AZZ Inc. (NYSE: AZZ), the leading independent provider of hot-dip galvanizing and coil coating solutions, today announced financial results for the first quarter ended May 31, 2025.